Mastercard Incorporated, a global leader in payment processing technology, continues to perform strongly in the financial sector. Mastercard’s stock is of great interest to investors as a key player in the global payments industry. This article explores the price prediction for Mastercard using insights from various financial analyses.

Current Market Performance

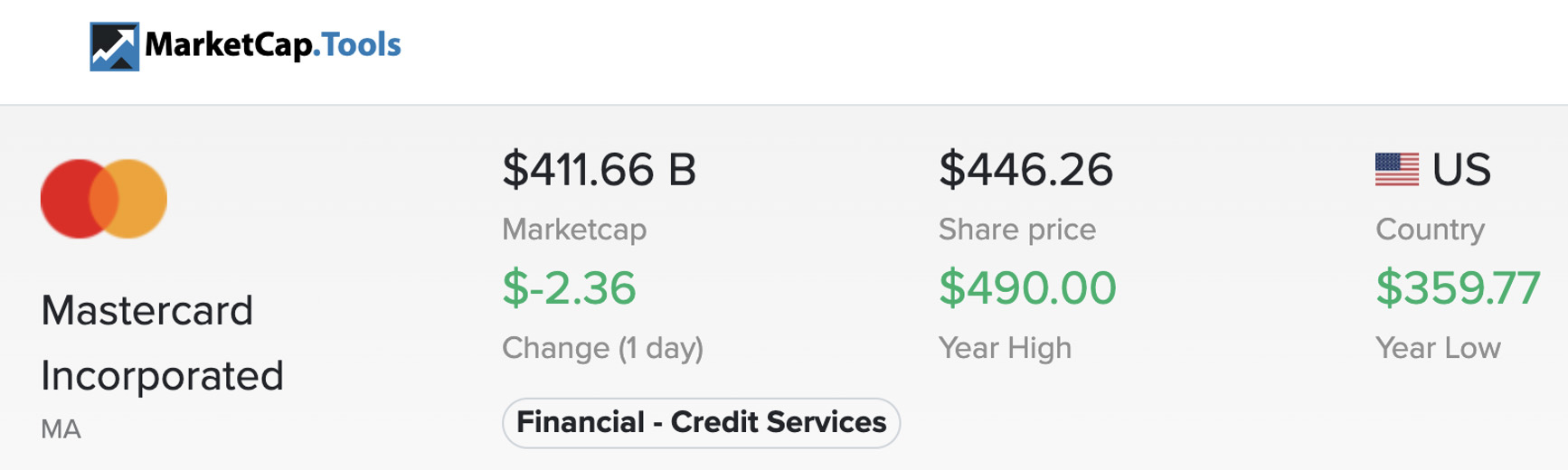

Mastercard has demonstrated consistent growth, driven by increasing global digital transactions and expanding financial inclusion initiatives. The company’s strategic partnerships and innovations in payment technologies have further strengthened its market position. For real-time updates and detailed financial data, you can visit Market Cap Tools.

Analyst Predictions and Trends

- Strong Growth Prospects: Financial analysts maintain a positive outlook on Mastercard, citing its robust growth in transaction volumes and revenue. The shift towards digital payments, especially accelerated by the COVID-19 pandemic, continues to benefit Mastercard significantly.

- Earnings Growth: Mastercard’s earnings reports have consistently met or exceeded expectations, contributing to upward stock price predictions. Analysts forecast that the company’s focus on expanding its digital payment solutions and entering new markets will sustain its earnings growth.

- Technological Innovation: Mastercard’s investment in cutting-edge payment technologies, such as contactless payments, blockchain, and cybersecurity, positions it well for future growth. These innovations are expected to drive increased adoption and usage of Mastercard’s payment network.

Potential Risks and Considerations

Potential Risks and Considerations

- Regulatory Challenges: Mastercard faces regulatory scrutiny in various jurisdictions as a global financial entity. Changes in regulatory policies or new compliance requirements could impact the company’s operations and profitability. Investors should monitor regulatory developments closely.

- Market Competition: The payments industry is highly competitive, with major players like Visa, American Express, and emerging fintech companies. Mastercard’s ability to maintain its competitive edge through innovation and strategic partnerships is crucial for its continued success.

- Economic Factors: Economic conditions, such as consumer spending trends and global economic stability, significantly influence Mastercard’s performance. Economic downturns or changes in consumer behavior can impact transaction volumes and revenue growth.

What is the Price Prediction for MasterCard?

The price prediction for Mastercard reflects a generally positive outlook driven by strong market performance, innovative payment solutions, and consistent earnings growth. However, potential risks from regulatory changes and market competition should be considered. Investors are encouraged to stay informed about the latest developments in the payments industry and Mastercard’s strategic initiatives.

For more detailed insights and up-to-date market analysis, visit Market Cap Tools.

Market capitalization for similar companies or competitors:

1 – Ally Finance Inc

2 – American Express